Oakland County Michigan Real Estate Transfer Tax . calculating the michigan real estate transfer tax. Use our michigan property transfer tax calculator tool to compute your rate when you sell your home. michigan's current transfer tax rate is $4.30 per $500. calculate michigan transfer tax on real estate. the millage rate database and property tax estimator allows individual and business taxpayers to estimate their current property. current local tax information is available by contacting your local treasurer’s office. here’s a quick look at how it works in michigan. This includes $3.75 per $500 to the state plus $0.55 per $500 to the county. When property taxes are not paid to the city or. The real estate transfer tax includes two components: In michigan, real estate transactions exceeding. in accordance with the michigan constitution as amended by michigan statutes, a transfer of ownership causes the taxable value of the.

from www.hauseit.com

The real estate transfer tax includes two components: calculate michigan transfer tax on real estate. calculating the michigan real estate transfer tax. michigan's current transfer tax rate is $4.30 per $500. This includes $3.75 per $500 to the state plus $0.55 per $500 to the county. When property taxes are not paid to the city or. in accordance with the michigan constitution as amended by michigan statutes, a transfer of ownership causes the taxable value of the. Use our michigan property transfer tax calculator tool to compute your rate when you sell your home. the millage rate database and property tax estimator allows individual and business taxpayers to estimate their current property. In michigan, real estate transactions exceeding.

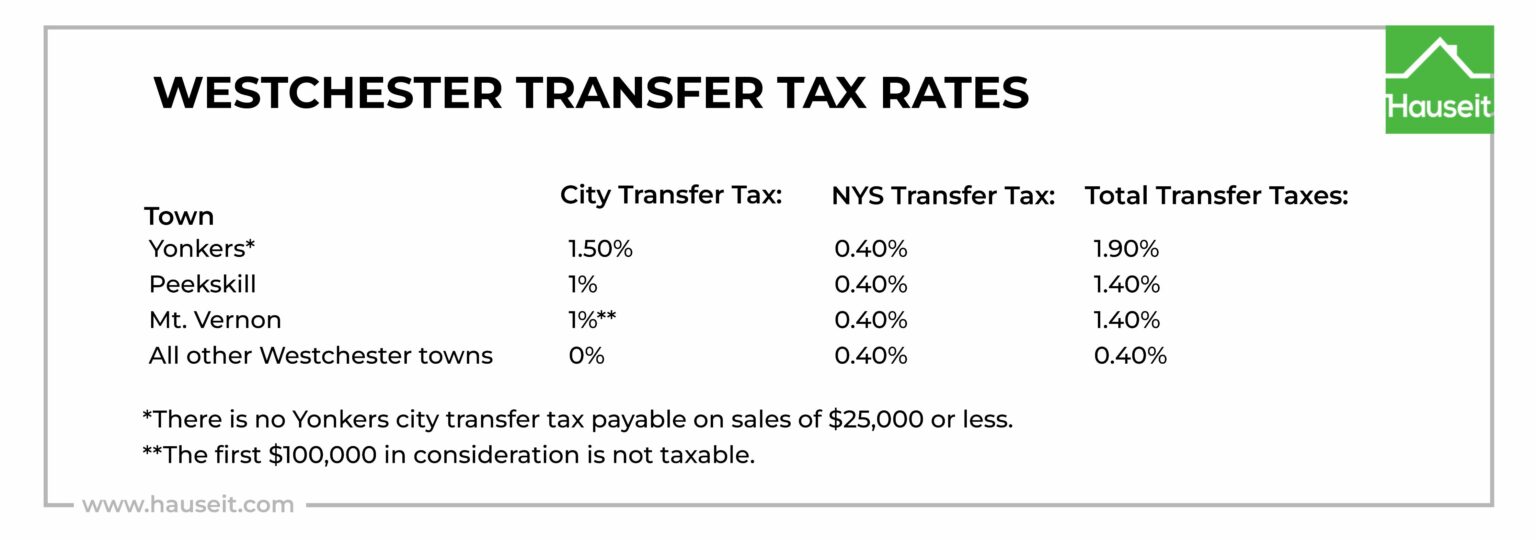

How Much Are Real Estate Transfer Taxes in Westchester County?

Oakland County Michigan Real Estate Transfer Tax calculating the michigan real estate transfer tax. The real estate transfer tax includes two components: michigan's current transfer tax rate is $4.30 per $500. This includes $3.75 per $500 to the state plus $0.55 per $500 to the county. Use our michigan property transfer tax calculator tool to compute your rate when you sell your home. In michigan, real estate transactions exceeding. calculating the michigan real estate transfer tax. calculate michigan transfer tax on real estate. current local tax information is available by contacting your local treasurer’s office. When property taxes are not paid to the city or. here’s a quick look at how it works in michigan. the millage rate database and property tax estimator allows individual and business taxpayers to estimate their current property. in accordance with the michigan constitution as amended by michigan statutes, a transfer of ownership causes the taxable value of the.

From silverlaw.ca

What do I need to know about Property Transfer Tax? Silver Law Oakland County Michigan Real Estate Transfer Tax calculating the michigan real estate transfer tax. The real estate transfer tax includes two components: the millage rate database and property tax estimator allows individual and business taxpayers to estimate their current property. in accordance with the michigan constitution as amended by michigan statutes, a transfer of ownership causes the taxable value of the. michigan's current. Oakland County Michigan Real Estate Transfer Tax.

From help.ltsa.ca

File a Property Transfer Tax Return LTSA Help Oakland County Michigan Real Estate Transfer Tax in accordance with the michigan constitution as amended by michigan statutes, a transfer of ownership causes the taxable value of the. calculating the michigan real estate transfer tax. The real estate transfer tax includes two components: In michigan, real estate transactions exceeding. calculate michigan transfer tax on real estate. the millage rate database and property tax. Oakland County Michigan Real Estate Transfer Tax.

From www.newhomesource.com

Your Guide to Closing Costs in Michigan in 2021 Oakland County Michigan Real Estate Transfer Tax This includes $3.75 per $500 to the state plus $0.55 per $500 to the county. Use our michigan property transfer tax calculator tool to compute your rate when you sell your home. In michigan, real estate transactions exceeding. When property taxes are not paid to the city or. calculating the michigan real estate transfer tax. in accordance with. Oakland County Michigan Real Estate Transfer Tax.

From www.dreamlandestate.com

The Comprehensive Guide To Real Estate Transfer Taxes Oakland County Michigan Real Estate Transfer Tax calculating the michigan real estate transfer tax. the millage rate database and property tax estimator allows individual and business taxpayers to estimate their current property. This includes $3.75 per $500 to the state plus $0.55 per $500 to the county. michigan's current transfer tax rate is $4.30 per $500. current local tax information is available by. Oakland County Michigan Real Estate Transfer Tax.

From www.realtor.com

Oakland County, MI Real Estate & Homes for Sale Oakland County Michigan Real Estate Transfer Tax When property taxes are not paid to the city or. in accordance with the michigan constitution as amended by michigan statutes, a transfer of ownership causes the taxable value of the. In michigan, real estate transactions exceeding. current local tax information is available by contacting your local treasurer’s office. The real estate transfer tax includes two components: . Oakland County Michigan Real Estate Transfer Tax.

From www.uslegalforms.com

Michigan Application for Real Estate Transfer Tax Refund State Of Michigan Tax Refund US Oakland County Michigan Real Estate Transfer Tax the millage rate database and property tax estimator allows individual and business taxpayers to estimate their current property. The real estate transfer tax includes two components: calculate michigan transfer tax on real estate. calculating the michigan real estate transfer tax. Use our michigan property transfer tax calculator tool to compute your rate when you sell your home.. Oakland County Michigan Real Estate Transfer Tax.

From www.formsbirds.com

Real Property Transfer Tax Return Free Download Oakland County Michigan Real Estate Transfer Tax the millage rate database and property tax estimator allows individual and business taxpayers to estimate their current property. current local tax information is available by contacting your local treasurer’s office. calculate michigan transfer tax on real estate. Use our michigan property transfer tax calculator tool to compute your rate when you sell your home. michigan's current. Oakland County Michigan Real Estate Transfer Tax.

From www.pdffiller.com

Fillable Online Property transfer tax return guide Fax Email Print pdfFiller Oakland County Michigan Real Estate Transfer Tax the millage rate database and property tax estimator allows individual and business taxpayers to estimate their current property. calculating the michigan real estate transfer tax. The real estate transfer tax includes two components: In michigan, real estate transactions exceeding. in accordance with the michigan constitution as amended by michigan statutes, a transfer of ownership causes the taxable. Oakland County Michigan Real Estate Transfer Tax.

From www.cbpp.org

State “Mansion Taxes” on Very Expensive Homes Center on Budget and Policy Priorities Oakland County Michigan Real Estate Transfer Tax in accordance with the michigan constitution as amended by michigan statutes, a transfer of ownership causes the taxable value of the. calculating the michigan real estate transfer tax. When property taxes are not paid to the city or. This includes $3.75 per $500 to the state plus $0.55 per $500 to the county. In michigan, real estate transactions. Oakland County Michigan Real Estate Transfer Tax.

From www.hauseit.com

How Much Are Real Estate Transfer Taxes in Los Angeles? Oakland County Michigan Real Estate Transfer Tax michigan's current transfer tax rate is $4.30 per $500. the millage rate database and property tax estimator allows individual and business taxpayers to estimate their current property. here’s a quick look at how it works in michigan. calculating the michigan real estate transfer tax. Use our michigan property transfer tax calculator tool to compute your rate. Oakland County Michigan Real Estate Transfer Tax.

From www.realtor.com

Oakland County, MI Real Estate & Homes for Sale Oakland County Michigan Real Estate Transfer Tax In michigan, real estate transactions exceeding. calculating the michigan real estate transfer tax. This includes $3.75 per $500 to the state plus $0.55 per $500 to the county. Use our michigan property transfer tax calculator tool to compute your rate when you sell your home. When property taxes are not paid to the city or. The real estate transfer. Oakland County Michigan Real Estate Transfer Tax.

From www.formsbank.com

Form 7551 Real Property Transfer Tax Declaration printable pdf download Oakland County Michigan Real Estate Transfer Tax here’s a quick look at how it works in michigan. calculate michigan transfer tax on real estate. In michigan, real estate transactions exceeding. michigan's current transfer tax rate is $4.30 per $500. in accordance with the michigan constitution as amended by michigan statutes, a transfer of ownership causes the taxable value of the. When property taxes. Oakland County Michigan Real Estate Transfer Tax.

From www.formsbank.com

Form 2719 Return For Real Estate Transfer Tax printable pdf download Oakland County Michigan Real Estate Transfer Tax This includes $3.75 per $500 to the state plus $0.55 per $500 to the county. In michigan, real estate transactions exceeding. the millage rate database and property tax estimator allows individual and business taxpayers to estimate their current property. The real estate transfer tax includes two components: in accordance with the michigan constitution as amended by michigan statutes,. Oakland County Michigan Real Estate Transfer Tax.

From www.templateroller.com

Form 2796 Download Fillable PDF or Fill Online Application for State Real Estate Transfer Tax Oakland County Michigan Real Estate Transfer Tax the millage rate database and property tax estimator allows individual and business taxpayers to estimate their current property. Use our michigan property transfer tax calculator tool to compute your rate when you sell your home. In michigan, real estate transactions exceeding. When property taxes are not paid to the city or. michigan's current transfer tax rate is $4.30. Oakland County Michigan Real Estate Transfer Tax.

From exozgttzj.blob.core.windows.net

Property Transfer Tax By Country at William Reser blog Oakland County Michigan Real Estate Transfer Tax calculate michigan transfer tax on real estate. michigan's current transfer tax rate is $4.30 per $500. This includes $3.75 per $500 to the state plus $0.55 per $500 to the county. in accordance with the michigan constitution as amended by michigan statutes, a transfer of ownership causes the taxable value of the. Use our michigan property transfer. Oakland County Michigan Real Estate Transfer Tax.

From formspal.com

Real Estate Transfer Declaration PDF Form FormsPal Oakland County Michigan Real Estate Transfer Tax calculate michigan transfer tax on real estate. When property taxes are not paid to the city or. calculating the michigan real estate transfer tax. In michigan, real estate transactions exceeding. Use our michigan property transfer tax calculator tool to compute your rate when you sell your home. current local tax information is available by contacting your local. Oakland County Michigan Real Estate Transfer Tax.

From www.hauseit.com

How Much Are Real Estate Transfer Taxes in Westchester County? Oakland County Michigan Real Estate Transfer Tax in accordance with the michigan constitution as amended by michigan statutes, a transfer of ownership causes the taxable value of the. calculate michigan transfer tax on real estate. This includes $3.75 per $500 to the state plus $0.55 per $500 to the county. In michigan, real estate transactions exceeding. michigan's current transfer tax rate is $4.30 per. Oakland County Michigan Real Estate Transfer Tax.

From productionrealty.com

Michigan Transfer Tax Refund Production Realty Oakland County Michigan Real Estate Transfer Tax in accordance with the michigan constitution as amended by michigan statutes, a transfer of ownership causes the taxable value of the. michigan's current transfer tax rate is $4.30 per $500. This includes $3.75 per $500 to the state plus $0.55 per $500 to the county. calculate michigan transfer tax on real estate. When property taxes are not. Oakland County Michigan Real Estate Transfer Tax.