What Is Flat Rate Expenses Allowance . flat rate expense (fre) allowances are those that cover certain employment related expenses. If you pay income tax at the basic rate of 20%, you can claim. the fre allowance regime permits certain employees to claim an agreed expense deduction for qualifying. you are entitled to a flat rate allowance of £80 in your industry sector. this guide provides information on both, highlighting the differences between them, explaining what counts as a reasonable expense, how. an allowance is a separate amount your employer pays you in addition to your salary and wages. the rate per work hour (67c) includes the total deductible expenses for the above additional running expenses. you may also pay other kinds of allowances to your employees relating to transport (in a car, on public transport, or.

from www.taxback.com

an allowance is a separate amount your employer pays you in addition to your salary and wages. you are entitled to a flat rate allowance of £80 in your industry sector. this guide provides information on both, highlighting the differences between them, explaining what counts as a reasonable expense, how. the fre allowance regime permits certain employees to claim an agreed expense deduction for qualifying. flat rate expense (fre) allowances are those that cover certain employment related expenses. the rate per work hour (67c) includes the total deductible expenses for the above additional running expenses. you may also pay other kinds of allowances to your employees relating to transport (in a car, on public transport, or. If you pay income tax at the basic rate of 20%, you can claim.

New Flat Rate Deduction for Defence Forces

What Is Flat Rate Expenses Allowance you are entitled to a flat rate allowance of £80 in your industry sector. the fre allowance regime permits certain employees to claim an agreed expense deduction for qualifying. you may also pay other kinds of allowances to your employees relating to transport (in a car, on public transport, or. an allowance is a separate amount your employer pays you in addition to your salary and wages. If you pay income tax at the basic rate of 20%, you can claim. this guide provides information on both, highlighting the differences between them, explaining what counts as a reasonable expense, how. flat rate expense (fre) allowances are those that cover certain employment related expenses. you are entitled to a flat rate allowance of £80 in your industry sector. the rate per work hour (67c) includes the total deductible expenses for the above additional running expenses.

From rebates.ie

Flat Rate Expenses Allowances Rebates What Is Flat Rate Expenses Allowance this guide provides information on both, highlighting the differences between them, explaining what counts as a reasonable expense, how. flat rate expense (fre) allowances are those that cover certain employment related expenses. If you pay income tax at the basic rate of 20%, you can claim. you may also pay other kinds of allowances to your employees. What Is Flat Rate Expenses Allowance.

From www.slideteam.net

Flat Rate Expense Allowance Ppt Powerpoint Presentation Pictures Ideas What Is Flat Rate Expenses Allowance the fre allowance regime permits certain employees to claim an agreed expense deduction for qualifying. you are entitled to a flat rate allowance of £80 in your industry sector. flat rate expense (fre) allowances are those that cover certain employment related expenses. an allowance is a separate amount your employer pays you in addition to your. What Is Flat Rate Expenses Allowance.

From moovick.com

Setting the Appropriate Allowance What Is Flat Rate Expenses Allowance If you pay income tax at the basic rate of 20%, you can claim. the rate per work hour (67c) includes the total deductible expenses for the above additional running expenses. flat rate expense (fre) allowances are those that cover certain employment related expenses. the fre allowance regime permits certain employees to claim an agreed expense deduction. What Is Flat Rate Expenses Allowance.

From www.slideserve.com

PPT Flat Rate Scheme and Expenses Claimable PowerPoint Presentation What Is Flat Rate Expenses Allowance flat rate expense (fre) allowances are those that cover certain employment related expenses. you may also pay other kinds of allowances to your employees relating to transport (in a car, on public transport, or. the rate per work hour (67c) includes the total deductible expenses for the above additional running expenses. an allowance is a separate. What Is Flat Rate Expenses Allowance.

From blog.paycheckplus.ie

Flat Rate Expenses Paycheck Plus Your Outsource Payroll Partner What Is Flat Rate Expenses Allowance this guide provides information on both, highlighting the differences between them, explaining what counts as a reasonable expense, how. you are entitled to a flat rate allowance of £80 in your industry sector. flat rate expense (fre) allowances are those that cover certain employment related expenses. If you pay income tax at the basic rate of 20%,. What Is Flat Rate Expenses Allowance.

From itasaccounting.ie

Flat Rate Expenses ITAS Accounting What Is Flat Rate Expenses Allowance flat rate expense (fre) allowances are those that cover certain employment related expenses. you may also pay other kinds of allowances to your employees relating to transport (in a car, on public transport, or. you are entitled to a flat rate allowance of £80 in your industry sector. If you pay income tax at the basic rate. What Is Flat Rate Expenses Allowance.

From zhenhub.com

The Advantages of Flat Rate Shipping What Is Flat Rate Expenses Allowance this guide provides information on both, highlighting the differences between them, explaining what counts as a reasonable expense, how. If you pay income tax at the basic rate of 20%, you can claim. an allowance is a separate amount your employer pays you in addition to your salary and wages. flat rate expense (fre) allowances are those. What Is Flat Rate Expenses Allowance.

From goshippo.com

USPS Flat Rate Box Sizes, Prices, and How it Works [Updated with 2019 What Is Flat Rate Expenses Allowance flat rate expense (fre) allowances are those that cover certain employment related expenses. the fre allowance regime permits certain employees to claim an agreed expense deduction for qualifying. you are entitled to a flat rate allowance of £80 in your industry sector. If you pay income tax at the basic rate of 20%, you can claim. . What Is Flat Rate Expenses Allowance.

From www.taxback.com

What are flat rate expenses? What Is Flat Rate Expenses Allowance you are entitled to a flat rate allowance of £80 in your industry sector. the fre allowance regime permits certain employees to claim an agreed expense deduction for qualifying. If you pay income tax at the basic rate of 20%, you can claim. an allowance is a separate amount your employer pays you in addition to your. What Is Flat Rate Expenses Allowance.

From rebates.ie

Flat Rate Expenses Allowances Rebates What Is Flat Rate Expenses Allowance the fre allowance regime permits certain employees to claim an agreed expense deduction for qualifying. you may also pay other kinds of allowances to your employees relating to transport (in a car, on public transport, or. If you pay income tax at the basic rate of 20%, you can claim. you are entitled to a flat rate. What Is Flat Rate Expenses Allowance.

From mandate.ie

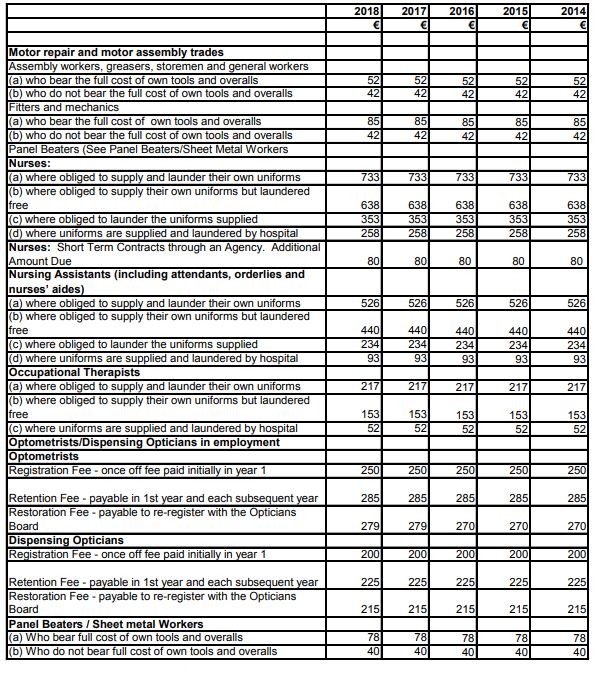

Claiming Flat Rate Expenses from Revenue Mandate Trade Union Ireland What Is Flat Rate Expenses Allowance this guide provides information on both, highlighting the differences between them, explaining what counts as a reasonable expense, how. the rate per work hour (67c) includes the total deductible expenses for the above additional running expenses. you are entitled to a flat rate allowance of £80 in your industry sector. If you pay income tax at the. What Is Flat Rate Expenses Allowance.

From resources.punchey.com

Flat Rate vs Hourly Pay Punchey Resources Howtoguides What Is Flat Rate Expenses Allowance flat rate expense (fre) allowances are those that cover certain employment related expenses. an allowance is a separate amount your employer pays you in addition to your salary and wages. you are entitled to a flat rate allowance of £80 in your industry sector. If you pay income tax at the basic rate of 20%, you can. What Is Flat Rate Expenses Allowance.

From www.taxback.com

New Flat Rate Deduction for Defence Forces What Is Flat Rate Expenses Allowance If you pay income tax at the basic rate of 20%, you can claim. this guide provides information on both, highlighting the differences between them, explaining what counts as a reasonable expense, how. the fre allowance regime permits certain employees to claim an agreed expense deduction for qualifying. you may also pay other kinds of allowances to. What Is Flat Rate Expenses Allowance.

From www.taxback.com

What are flat rate expenses? What Is Flat Rate Expenses Allowance this guide provides information on both, highlighting the differences between them, explaining what counts as a reasonable expense, how. If you pay income tax at the basic rate of 20%, you can claim. flat rate expense (fre) allowances are those that cover certain employment related expenses. you may also pay other kinds of allowances to your employees. What Is Flat Rate Expenses Allowance.

From www.taxback.com

What are flat rate expenses? What Is Flat Rate Expenses Allowance you may also pay other kinds of allowances to your employees relating to transport (in a car, on public transport, or. you are entitled to a flat rate allowance of £80 in your industry sector. this guide provides information on both, highlighting the differences between them, explaining what counts as a reasonable expense, how. flat rate. What Is Flat Rate Expenses Allowance.

From www.taxback.com

What are flat rate expenses? What Is Flat Rate Expenses Allowance you are entitled to a flat rate allowance of £80 in your industry sector. this guide provides information on both, highlighting the differences between them, explaining what counts as a reasonable expense, how. the rate per work hour (67c) includes the total deductible expenses for the above additional running expenses. the fre allowance regime permits certain. What Is Flat Rate Expenses Allowance.

From www.taxbanana.com

What's a flat rate expense allowance and can I claim one? Tax Banana What Is Flat Rate Expenses Allowance you are entitled to a flat rate allowance of £80 in your industry sector. If you pay income tax at the basic rate of 20%, you can claim. an allowance is a separate amount your employer pays you in addition to your salary and wages. the rate per work hour (67c) includes the total deductible expenses for. What Is Flat Rate Expenses Allowance.

From www.taxback.com

New Flat Rate Deduction for Defence Forces What Is Flat Rate Expenses Allowance this guide provides information on both, highlighting the differences between them, explaining what counts as a reasonable expense, how. you may also pay other kinds of allowances to your employees relating to transport (in a car, on public transport, or. an allowance is a separate amount your employer pays you in addition to your salary and wages.. What Is Flat Rate Expenses Allowance.